The questions that I am most frequently asked when I present to groups, especially young adult groups, are about investing. So I thought I would do a blog series to talk about the basics of investing. I hope to explain the why’s and how’s in a way that helps you get basic information without being overwhelmed. Let’s get started with one answer to the question, “Why Invest?”

Excerpt from The Graduate’s Guide to Money:

You could fill libraries with all of the books written about investing. The good news is, you don’t have to know everything about technical analysis and portfolio theory to be an investor. Obtain some basic knowledge and then, over time, build up experience. The best place to start is to examine your reasons for investing.

Why Invest? The Power of Compounding

To understand why investing should be part of your financial plan, you should understand the power of compounding and the impact of inflation. Remember the amortization schedule shown in Chapter 5 when examining how to pay off your debt? Think about this from the perspective of a lender:

Suppose you loan someone $1,000 at 5 percent interest and they repay you over a year. You make $27.29 in interest. Fine, but what if you don’t actually want to be repaid right now? You want to let the borrower use that money for a long time and pay you interest, which keeps getting added to the original principal you loaned them. This is called compound interest because instead of getting interest payments every month, the interest payments are added to the principal, so you, the lender, get paid interest on the interest. This is how a basic savings account works: you are lending the bank money; they pay you interest every month which adds to the balance and then the interest is calculated on the higher balance. You, as a “lender” to the bank, get an investment return on your money.

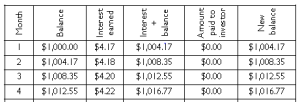

Here’s what that looks like:

See how the new balance includes the interest already earned? At the end of one year, you have earned $51.16 instead of $27.29. Now you see how interest on interest works and why it matters.

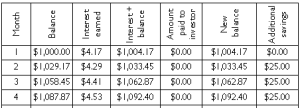

Consider what would happen with the same savings by adding just $25 every month:

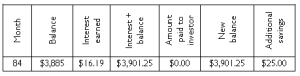

See how your interest grows each month as you add more principal? After seven years, you would have $3,901.25 consisting of $3,075 of principal ($1,000 + 2,075 [7 x 12 x 25] – 25 since you didn’t put in month one) and $826.25 of interest.

Here is what it looks like in the last month of year seven:

Your monthly income is increasing, and that is just on $25 per month.

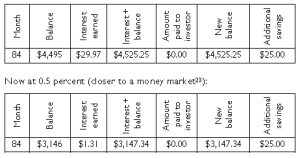

The rate matters, though. Take a look at this view of year seven at 8 percent:

When examining compounding, both the rate and the length of time matter. As a young adult, you have a long time period to invest, so if you consistently add principal and keep compounding the interest, you could accumulate some sizable investment balances.

End excerpt.

Note: If you use excel, you can search their templates for amortization schedules and recreate these schedules. The amortization schedule has the viewpoint of being the person who is repaying the debt but you can imagine it from the perspective of the person being paid that interest as well.

So, why invest? Answer number 1 is: The Power of Compounding

Next week, we’ll give you answer number 2.

To your financial success!